tomcraft.ru

Overview

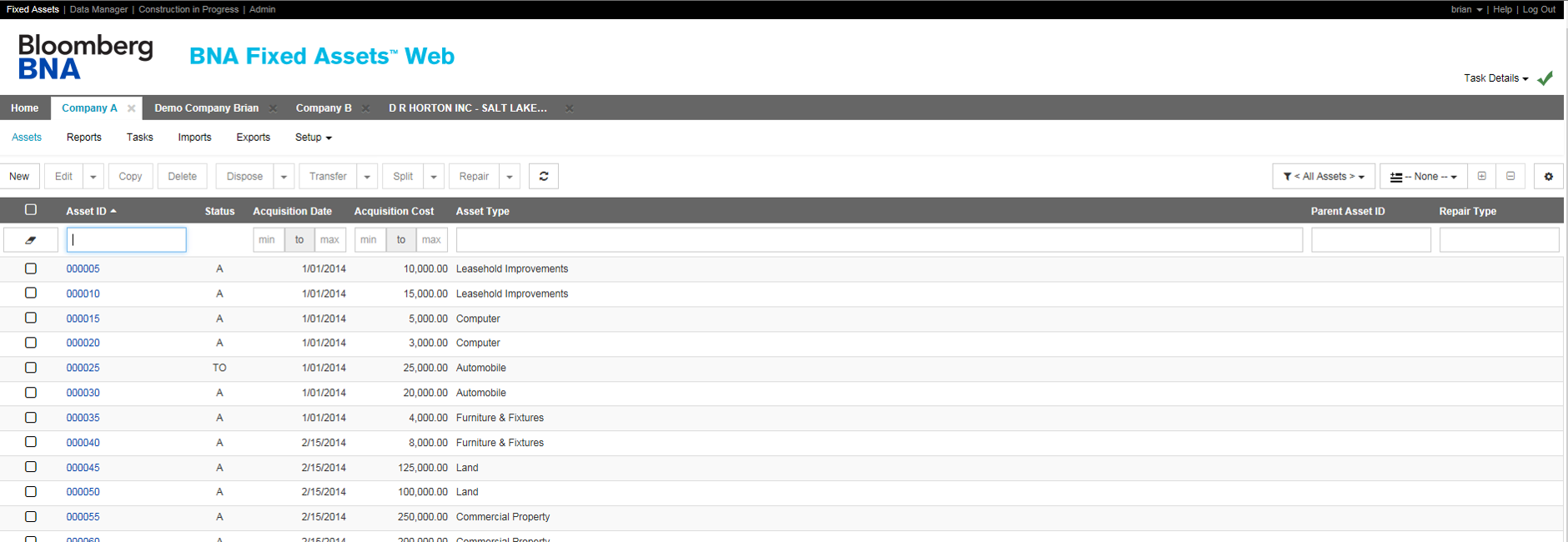

Bloomberg Fixed Assets

Bloomberg Tax and Accounting Fixed Assets software delivers consolidation and reporting capabilities. Find user reviews, pros, cons, and more. Digital Assets · Equity · ESG & Climate · Fixed Income · Multi-Asset · Reference Rates · Thematic · Indices Resources. Industry-standard and bespoke benchmarks. We finished the fixed asset changes and additions a full two days ahead of where we normally were. It's been life-changing when it comes to our processes. Bloomberg Tax: Fixed Asset. 68K views · 2 years ago more. Bloomberg Sage Fixed Assets for Sage & Sage Intacct. Acumen. Products ; Bloomberg Tax Fixed Assets, Corporate Tax Software. Fixed Assets is a cloud-based software offered by Bloomberg Tax & Accounting that helps to automate and manage the entire fixed asset life cycle, from. Bloomberg Tax & Accounting Fixed Assets software is a cloud-based solution that helps companies manage the entire lifecycle of their fixed assets. Bloomberg Fixed Assets is fast, easy to navigate, and most importantly, correct. Upgrading to the online program has been a huge timesaver for us. Fixed Assets enables tax and accounting professionals in companies of any size to gain a solid foundation for all fixed assets and depreciation management. Bloomberg Tax and Accounting Fixed Assets software delivers consolidation and reporting capabilities. Find user reviews, pros, cons, and more. Digital Assets · Equity · ESG & Climate · Fixed Income · Multi-Asset · Reference Rates · Thematic · Indices Resources. Industry-standard and bespoke benchmarks. We finished the fixed asset changes and additions a full two days ahead of where we normally were. It's been life-changing when it comes to our processes. Bloomberg Tax: Fixed Asset. 68K views · 2 years ago more. Bloomberg Sage Fixed Assets for Sage & Sage Intacct. Acumen. Products ; Bloomberg Tax Fixed Assets, Corporate Tax Software. Fixed Assets is a cloud-based software offered by Bloomberg Tax & Accounting that helps to automate and manage the entire fixed asset life cycle, from. Bloomberg Tax & Accounting Fixed Assets software is a cloud-based solution that helps companies manage the entire lifecycle of their fixed assets. Bloomberg Fixed Assets is fast, easy to navigate, and most importantly, correct. Upgrading to the online program has been a huge timesaver for us. Fixed Assets enables tax and accounting professionals in companies of any size to gain a solid foundation for all fixed assets and depreciation management.

Overall Review Sentiment for Bloomberg Tax & Accounting Fixed Assets · 1. Ease of running depreciation reports for past or future periods. · 2. The ability to. Bloomberg Tax & Accounting Software ("BTAS") provides commercial tax Fixed Assets Fixed Assets is a comprehensive fixed asset management solution. Our survey shows that organizations continue to rely on these high-effort, high-risk manual processes to manage fixed assets tax data, calculate federal and. Featured Speakers: Alees Marti, Domestic Tax Manager at Starbucks; Carl Thompson, Senior Product Manager at Bloomberg BNA. With an introduction from Paul. Discover how to mitigate risk and wasted time that comes with other fixed assets software by switching to Bloomberg Tax. - Track assets and depreciation through the entire fixed asset life cycle—from CIP to disposal. - Maintain your asset inventory. - Complete reporting for. importing assets is a Bloomberg Tax Fixed Assets application, the source file you create (when you export asset data from your original application) will be. We use Bloomberg Fixed Assets for GAAP, Fed and State Tax depreciation. Within their software there are countless options to describe an asset, organize, and. View all the Bloomberg Tax Fixed Assets integrations with top tools. Filter and explore the functionalities available to make the best software decision. This guide provides instructions for installing and activating. Bloomberg Tax Fixed Assets (Desktop and DesktopPro Installing Fixed Assets Desktop or Fixed. Bloomberg Tax Fixed Assets software is a cloud-based platform that automates and manages the complete lifecycle of your fixed assets. Streamline. Bloomberg Tax & Accounting Fixed Assets offers complete control over every aspect of fixed assets and the solution is designed to grow with organizations. Verified list of companies using Bloomberg Tax\'s Fixed Assets for, along with their revenues, number of employees, the industry they work in and location. Bloomberg Tax & Accounting Fixed Assets is a cloud-based and on-premise platform developed by Bloomberg to help manage and automate the entire fixed asset. Bloomberg Tax Fixed Assets is a fixed asset management software solution that maintains company assets throughout their entire lifecycles. The program is. 17 Bloomberg Bna Fixed Assets jobs available on tomcraft.ru Apply to Tax Analyst, Income Manager, Analyst and more! Compare Bloomberg Tax & Accounting Fixed Assets and CCH Tax head-to-head across pricing, user satisfaction, and features, using data from actual users. This concept tracks investment in or capital expenditures on fixed assets such as buildings, plant, equipment, machinery, etc. Bloomberg Tax & Accounting Fixed Assets is equipped with flexible integration capabilities and powered via the Advantage platform. It empowers businesses by.

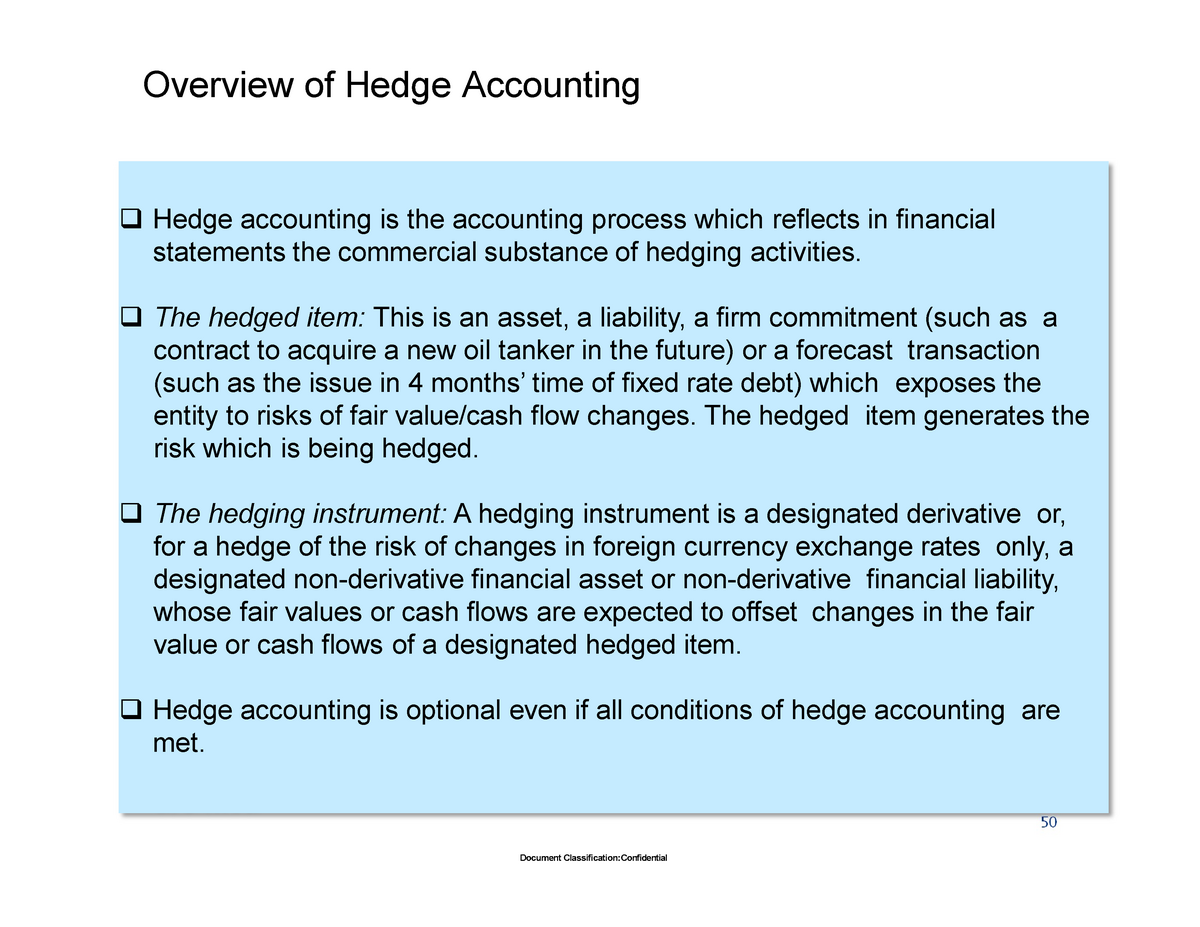

What Is Hedge Accounting

Hedge accounting is derived from hedging as a concept. As with the more commonly known hedge funds, this approach is used to lower the risk of overall losses by. Hedge accounting is designed to reduce volatility caused by the mismatch between the timing of gains or losses in hedged items and their corresponding hedging. Hedge accounting, which is optional, appeals to companies involved in hedging activities. It matches gains and losses on hedging instruments with the hedged. Hedge accounting is a matching concept that adjusts the normal basis for recognizing gains and losses (or income and expenses) on associated hedging instruments. Hedge accounting is a technique used in the financial statements to reflect the effects of risk management. Many companies will experience certain risks. A cash flow hedge is used when the bank wants to hedge the risk of future (and unknown) cash flows of a particular instrument or book of instruments. In other. Hedge accounting is a practice that allows the change in the value of a financial instrument, such as a mortgage, to be offset by the change in the value of. An overview of Hedge Accounting Share: Derivatives are often used to mitigate or offset risks (such as interest or currency risk) that arise from corporate. Hedge accounting offers a way for businesses to reduce volatility in their profit and loss statements. Here's a closer look at how hedging works and how. Hedge accounting is derived from hedging as a concept. As with the more commonly known hedge funds, this approach is used to lower the risk of overall losses by. Hedge accounting is designed to reduce volatility caused by the mismatch between the timing of gains or losses in hedged items and their corresponding hedging. Hedge accounting, which is optional, appeals to companies involved in hedging activities. It matches gains and losses on hedging instruments with the hedged. Hedge accounting is a matching concept that adjusts the normal basis for recognizing gains and losses (or income and expenses) on associated hedging instruments. Hedge accounting is a technique used in the financial statements to reflect the effects of risk management. Many companies will experience certain risks. A cash flow hedge is used when the bank wants to hedge the risk of future (and unknown) cash flows of a particular instrument or book of instruments. In other. Hedge accounting is a practice that allows the change in the value of a financial instrument, such as a mortgage, to be offset by the change in the value of. An overview of Hedge Accounting Share: Derivatives are often used to mitigate or offset risks (such as interest or currency risk) that arise from corporate. Hedge accounting offers a way for businesses to reduce volatility in their profit and loss statements. Here's a closer look at how hedging works and how.

The proposals will replace the rule-based hedge accounting requirements in. IAS 39 Financial Instruments: Recognition and Measurement and more closely align the. Hedge accounting is intended to deal with this accounting mismatch. By adjusting the basis of accounting for the hedged item (Fair Value Hedge) or the hedging. Hedge accounting results in offsetting gains and losses arising from the hedged item and hedging instrument being recognized in earnings in the same accounting. Hedge accounting modifies your company's accounts to give the reader an accurate picture, rather than a picture distorted by random currency movements. Hedge accounting is a practice in accounting where the entries used to adjust the fair value of a derivative also include the value of the. For derivatives that qualify as cash flow hedges, the entire change in the fair value of the hedging instrument is reported in Other Comprehensive Income (“OCI”). Hedge accounting is an accounting approach in which derivative transactions that are defined as hedges are associated with a specific existing exposure so. Rules related to portfolio fair value hedge are still under consideration. While the declared objective of. IFRS 9 is to move hedge accounting processes closer. It requires you to recognize derivative instruments as assets and liabilities in their statements of financial position and then to measure them at fair value. Kyriba offers a complete FX Risk Management solution with market data, FX exposure aggregation, trade management, settlements, and derivative hedge accounting. IFRS 9 hedge accounting applies to all hedge relationships, with the exception of fair value hedges of the interest rate exposure of a portfolio of financial. As a result of applying hedge accounting in a qualifying cash flow hedging relationship, an entity defers the income statement recognition of changes in the. Wolters Kluwer's OneSumX Hedge Accounting solution takes a modular approach to support the full range of tasks related to hedging activities, and helps you. Hedge accounting · allowing the fair value option for certain credit exposures and own-use contracts; · allowing further use of cash instruments as hedging. Gains and losses on remeasurement of derivatives intended for cash flow hedges are recognized in equity under other comprehensive income and reversed to profit. External links · IAS 39 summary as provided by Deloitte's IAS Plus website · Basic Fixed Income Derivative Hedging - Article on tomcraft.ru · Hedge. The accounting process involves adjusting an instrument's value to fair value, which typically culminates in significant changes in profit and loss. FINCAD's automated, web-based hedge accounting solution enables you to spend less time valuing hedges in spreadsheets, so you can focus on your core. A hedge of the exposure to variability in the cash flows of a recognized asset or liability, or of a forecasted transaction, that is attributable to a. Hedge Accounting. Hedge accounting allows companies to recognise gains and losses on hedging instruments and the exposure they are intended to hedge, with both.

Ways To Lower Credit Card Debt

Cut your expenses to the bone, spend not a single penny. Get extra second jobs. Pay off his first, then yours. Don't drain the Roth. Use all of. Ways to pay off credit card debts. · Limit credit card use. If you have only one card, try to limit your use. · Use a card with no balance for normal purchases. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. 1: Cut up the cards. Stop charging purchases, use cash or debit. · 2: Pay more than minimum to just one CC company. this pays that card off. Target one debt at a time · Focus on high-interest debt · Try the snowball method ; Consolidate debt · Transfer balances · Tap into your home equity ; Review your. Credit card debt reduction in 4 easy steps · Call your credit card companies to negotiate lower interest rates. · Revisit your budget to free up as much cash flow. 1. Understand how the debt happened · 2. Consider debt payoff strategies · 3. Pay more than the minimum · 4. Reduce spending · 5. Switch to cash · 6. Consolidate or. Create a credit card repayment plan · Stop adding to your debt · Follow the debt snowball method · Follow the debt avalanche method · Find ways to earn more. 8 Tips to Manage and Reduce Credit Card Debt · 1. Continue to Pay Your Credit Card Bills on Time · 2. Practice Responsible Spending · 3. Choose a Credit Card. Cut your expenses to the bone, spend not a single penny. Get extra second jobs. Pay off his first, then yours. Don't drain the Roth. Use all of. Ways to pay off credit card debts. · Limit credit card use. If you have only one card, try to limit your use. · Use a card with no balance for normal purchases. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. 1: Cut up the cards. Stop charging purchases, use cash or debit. · 2: Pay more than minimum to just one CC company. this pays that card off. Target one debt at a time · Focus on high-interest debt · Try the snowball method ; Consolidate debt · Transfer balances · Tap into your home equity ; Review your. Credit card debt reduction in 4 easy steps · Call your credit card companies to negotiate lower interest rates. · Revisit your budget to free up as much cash flow. 1. Understand how the debt happened · 2. Consider debt payoff strategies · 3. Pay more than the minimum · 4. Reduce spending · 5. Switch to cash · 6. Consolidate or. Create a credit card repayment plan · Stop adding to your debt · Follow the debt snowball method · Follow the debt avalanche method · Find ways to earn more. 8 Tips to Manage and Reduce Credit Card Debt · 1. Continue to Pay Your Credit Card Bills on Time · 2. Practice Responsible Spending · 3. Choose a Credit Card.

Reduce the balances on any open credit cards. · Pay your bills on time—this will affect your credit score the most. · Review your credit report and correct any. Regardless of the reason for your delinquency (job loss, inflation or illness), contacting your credit card company early on improves your chances of avoiding a. Highlights: · To keep your account in good standing, always make the minimum monthly payment · Try to pay more than the minimum to reduce your balance · Avoid. The first is the avalanche approach. Begin with your cards with the highest interest rates and balances. Make the minimum payments on the lower-interest cards. Talk with your credit card company, even if you've been turned down before for a lower interest rate or other help with your debt. Instead of paying a company. How to Attack Credit Card Debt · Pay More than the Minimum · Pay Off the Highest Interest Rate First · Avoid New Debts · Transfer Your Balances · Consolidate Your. How can I pay off my credit card debt? · Lower or pause your payments to see if your finances get better · Pause or lower interest and other charges on your. How to pay off credit card debt · 1. Pay more than the minimum · 2. Choose a payoff strategy · 3. Consider consolidation · 4. Use a balance transfer card · 5. Seek. Try to pay what you can afford towards your credit card. More interest is added as the balance gets bigger. Try to keep your balance low. Look into a balance transfer. This option allows you to pay off one credit card balance with a separate card that has a lower interest rate. Do consider this. What to Do · List your credit cards from highest interest rate to lowest. · Pay only the minimum payment due on cards with lower interest rates. · Pay additional. If high interest rates are in the way, transfer your balance to a card with a lower rate at another financial institution. A balance transfer can also help with. Pay off credit cards with a high interest rate first to minimize the amount of interest you accrue. Look into consolidation options, like a home equity line of. Cut Monthly Bill Costs - Paying a high monthly cost for your phone, utilities and other necessary bills can add up. · Pay Less Interest Overall - A high interest. The avalanche method also involves paying off your credit cards one at a time. However, you prioritize their order based on interest rate, not balance. You'll. Credit card debt reduction in 4 easy steps · Call your credit card companies to negotiate lower interest rates. · Revisit your budget to free up as much cash flow. Pay your bills on time, every time: This comprises 35% of your score. · Keep your balances low: Your credit card balances should stay below 30% of your credit. The least aggressive debt payoff method is making only the minimum payments. Experts advise you only pay the minimums when your main goals are to keep your. 1: Cut up the cards. Stop charging purchases, use cash or debit. · 2: Pay more than minimum to just one CC company. this pays that card off. Although the credit terms and agreements provided by the CFPB are subject to change and you should contact issuers for current rates, fee, and other types of.

Digital Goods Games

Buy in-game currency for popular games. Sell accounts and skins. Automatic delivery. Top up game accounts. Profitably sell and buy digital goods. DRM-Free Digital Downloads. Secure Checkout. Digital goods are commodities or products that exist in a digital form, something that can be sold and consumed online. Digital downloads are a convenient, fast, easy way to access video games, computer software, gift cards and more. Once you've bought your downloadable item. tomcraft.ru is a digital distribution platform – an online store with a curated selection of games, an optional gaming client giving you freedom of choice, and a. Greetings to all! I plan to sell digital goods such as video games, Microsoft/adobe computer programs, Tinder, xbox, and other digital goods, who can. Digital purchases are purchases for digital goods completed directly from within the app. Typically, these purchases are for additional content or premiums. (Digital Distribution) and mobile apps; cloud-based applications and online games; virtual goods used within the virtual economies of online games and. My bank says the charge says digital goods. I put it in dispute and it has me questioning if I should keep the plan or just move to the Mac. Buy in-game currency for popular games. Sell accounts and skins. Automatic delivery. Top up game accounts. Profitably sell and buy digital goods. DRM-Free Digital Downloads. Secure Checkout. Digital goods are commodities or products that exist in a digital form, something that can be sold and consumed online. Digital downloads are a convenient, fast, easy way to access video games, computer software, gift cards and more. Once you've bought your downloadable item. tomcraft.ru is a digital distribution platform – an online store with a curated selection of games, an optional gaming client giving you freedom of choice, and a. Greetings to all! I plan to sell digital goods such as video games, Microsoft/adobe computer programs, Tinder, xbox, and other digital goods, who can. Digital purchases are purchases for digital goods completed directly from within the app. Typically, these purchases are for additional content or premiums. (Digital Distribution) and mobile apps; cloud-based applications and online games; virtual goods used within the virtual economies of online games and. My bank says the charge says digital goods. I put it in dispute and it has me questioning if I should keep the plan or just move to the Mac.

What are digital goods and services? Essentially, they're things you buy in the digital world that don't arrive in the mail – online subscriptions, games. PayU offers % online payments for the digital goods industry across movies, music, games and e-books. In-Game Purchases: Contains in-game offers to purchase digital goods or premiums with real world currency, including but not limited to bonus levels, skins. Microsoft Gift Terms and Conditions (digital goods). Note Microsoft Store links may not be available in all markets The recipient can't redeem the. Virtual goods are non-physical objects and money purchased for use in online communities or online games. Video games, audiobooks, online classes, digital marketing tools — these digital goods to sell as a complement to your business. Profitable Digital. Discover a world of digital gaming at GameStop - your one-stop shop for all your gaming needs. Instantly access your favorite digital games and virtual. Digital also gives you the most options with exclusive discounts and deals, exclusive pre-order benefits, and the broadest selection of your desired games, add-. These include ebooks, music, digital art, software, online courses, and virtual goods sold inside video games. They're typically delivered to customers via. CodesWholesale is an online wholesale platform for B2B. Buy and sell game keys for Steam, Origin, Uplay, tomcraft.ru, Xbox, PSN and more! - CodesWholesale. Digital Goods are licensed solely for your personal, non-commercial use (which excludes use for promotional purposes), at a level customary for such use. Global games maker Square Enix enjoys revenue uplift through digital payments. · badoo logo · Millicom logo · Kilo Health logo · Cupid Media logo · Square Enix logo. But the lingo that goes with "purchasing" digital assets is false. You are not purchasing, you are leasing till your death. You cannot transfer. In-Game Purchases: Contains in-game offers to purchase digital goods or premiums with real world currency, including but not limited to bonus levels, skins. I do not have Xbox or any games. My bank says the charge says digital goods. I put it in dispute and it has me questioning if I should keep. PayU offers % online payments for the digital goods industry across movies, music, games and e-books. The term digital goods refers to goods that are stored, bought and used online. These can range from online subscriptions, game codes, credits, ebooks to. DIGITAL GOODS: GAMES. R. DIGITAL GOODS: APPLICATIONS (EXCLUDES GAMES). A. LARGE DIGITAL GOODS MERCHANT. A. PHARMCIES OR DRUG STORES. A. Online shopping for Video Games from a great selection of PC, Mac, PlayStation 4, PlayStation 3, Computer Video Games & more at everyday low prices. Global games maker Square Enix enjoys revenue uplift through digital payments. · badoo logo · Millicom logo · Kilo Health logo · Cupid Media logo · Square Enix logo.

Private Business Valuation

The three common methodologies used to value private businesses. Income Approach values a business or asset based on its expected future cash flow. One approach is to come up with an estimate of the equity value of the company, then use this to look up the size risk premium for your discount and cap rate. Private company valuation is a set of valuation methodologies used to determine the intrinsic value of a private company. For public companies, we can. In this article, we cover three main methods of business valuation: discounted cash flow, book value, and comparable company analysis. Our business valuation. A valuation will take into account a number of characteristics of the business such as its asset inventory or its cash flow when determining its true value. A. Ask a finance professor about the best business valuation method. The answer will be there are three approaches to choose from. Private company valuations are typically performed for three different reasons: transactions, compliance (financial or tax reporting), or litigation. A company with annual EBITDA of $1MM is generally worth between $2MM and $10MM. There are, of course, outliers where companies are worth more or less than this. Private company valuation is the process by which a private company is assessed for its current worth. Get Started - It's free! The three common methodologies used to value private businesses. Income Approach values a business or asset based on its expected future cash flow. One approach is to come up with an estimate of the equity value of the company, then use this to look up the size risk premium for your discount and cap rate. Private company valuation is a set of valuation methodologies used to determine the intrinsic value of a private company. For public companies, we can. In this article, we cover three main methods of business valuation: discounted cash flow, book value, and comparable company analysis. Our business valuation. A valuation will take into account a number of characteristics of the business such as its asset inventory or its cash flow when determining its true value. A. Ask a finance professor about the best business valuation method. The answer will be there are three approaches to choose from. Private company valuations are typically performed for three different reasons: transactions, compliance (financial or tax reporting), or litigation. A company with annual EBITDA of $1MM is generally worth between $2MM and $10MM. There are, of course, outliers where companies are worth more or less than this. Private company valuation is the process by which a private company is assessed for its current worth. Get Started - It's free!

While the same financial and valuation theory is used to value both public and private companies, there are distinct differences that appraisers and. Investors in public companies have a short-term time perspective, whereas owners of private companies have a long-term perspective. Small Business Valuation Methods · Price-To-Earnings Ratio (P/E) · Entry Cost Valuation · Asset Valuation · Market Comparison. A business valuation gives a company an absolute economic value. This final number can be reached in many ways, often with specific methods and formulas. Valuation methods for calculating Enterprise Value include, but are not limited to, discounted cash flow (DCF) analysis, using public company share prices, or. Your business's value is measured in profits. A company valuation is all about the money you make now and in the future. A buyer wants to know how much they can. The business must be valued by business valuation experts. Typically, they use one of two valuation approaches: the EBITDA Approach or the Asset Approach. A valuation approach commonly used by private equity and investment banking professionals, and the one we will focus on here, applies a multiple to Earnings. Determining the true value of a private company can be a difficult task, particularly if the relied-upon data is less-than-reliable. First, there are 3 different valuation approaches to value a business, the income, market, and asset approach. If your company had earnings of $2 per share, you would multiply it by 15 and would get a share price of $30 per share. If you own 10, shares, your equity. The standard method used within this industry is calculating a pro forma EBITDA and multiple forward assessment of risks to assume a reasonable investment. This article focuses on best practices for estimation of the WACC in the context of a private company valuation. Business valuation is a process and a set of procedures used to estimate the economic value of an owner's interest in a business. Here various valuation. In this tutorial, you'll learn how private companies are valued differently from public companies, including differences in the financial statements. Quickly build accurate and transparent comps with the world's largest source of deal multiples and private company valuations. BIZCOMPS - Main Street Private Company Transaction Comparables ; CONTACT US. Business Valuation Resources SW Columbia St, Suite Portland, OR Private companies face a unique set of challenges. Multiple rounds of financing can leave companies with a complicated and confusing capital structure, making. You'll need a private company valuation formula to determine the value of shares, ie, 5% or 10% of your business. A business valuation is an independent appraisal that assesses the worth of your company. This can be done in many ways, but it is commonly based on expected.

Electric Insurance Reviews

Need a carrier? Get to know more about Electric insurance ratings, pros & cons, and common questions. Compare auto, home, or renters insurance quotes and. Electric Insurance Review. by Ben Breiner. Ratings, reviews, and car insurance discounts for Electric Auto Insurance. Read More · Fred Loya Insurance. Electric insurance has been awesome! I've only had to do a claim one time, but it was super smooth and they guided me through the process step by step. The. reviews for Members' nuclear power generation sites, and other loss prevention services that support the Nuclear and Specialty Insurance programs. NEIL. Electric Insurance Company has an A rating from AM Best, indicating excellent financial strength, but is not rated by other reputable third-party agencies, like. A.M. Best has affirmed the Financial Strength Rating of A (Excellent) and the Long-Term Issuer Credit Rating of “a+” of Nuclear Electric Insurance Limited. Electric Insurance has an overall rating of out of 5, based on over reviews left anonymously by employees. 49% of employees would recommend working at. Electric insurance provides auto insurance, homeowners insurance, renters insurance and more. Reviews. Total 0. out of 5. 0 Reviews. icon. Transparency. Electric Insurance is a great place to start your career. I would recommend Electric Insurance if you're just starting your career and you're interested in the. Need a carrier? Get to know more about Electric insurance ratings, pros & cons, and common questions. Compare auto, home, or renters insurance quotes and. Electric Insurance Review. by Ben Breiner. Ratings, reviews, and car insurance discounts for Electric Auto Insurance. Read More · Fred Loya Insurance. Electric insurance has been awesome! I've only had to do a claim one time, but it was super smooth and they guided me through the process step by step. The. reviews for Members' nuclear power generation sites, and other loss prevention services that support the Nuclear and Specialty Insurance programs. NEIL. Electric Insurance Company has an A rating from AM Best, indicating excellent financial strength, but is not rated by other reputable third-party agencies, like. A.M. Best has affirmed the Financial Strength Rating of A (Excellent) and the Long-Term Issuer Credit Rating of “a+” of Nuclear Electric Insurance Limited. Electric Insurance has an overall rating of out of 5, based on over reviews left anonymously by employees. 49% of employees would recommend working at. Electric insurance provides auto insurance, homeowners insurance, renters insurance and more. Reviews. Total 0. out of 5. 0 Reviews. icon. Transparency. Electric Insurance is a great place to start your career. I would recommend Electric Insurance if you're just starting your career and you're interested in the.

Get more than discounts when you get a free online: car, home, condo, renters, or umbrella insurance quote. You can rely on our award-winning customer. Hero Electric Insurance Reviews & Ratings: Sort by worst and best customer reviews, ratings & testimonials based on their experiences shared by customers. Managing Atty. No Reviews. Litigation, Insurance Defense. April 18, Auto Insurance Cheapest Car Insurance In New Hampshire (). AM Best has affirmed the Financial Strength Rating of A (Excellent) and the Long-Term Issuer Credit Ratings of “a+” of Electric Insurance Company (EIC). 20 reviews of ELECTRIC INSURANCE "My wife and I have been Electric Insurance customers for over 16 years. Their rates and service are second to none! Electric Insurance Agency has a star rating with 90 reviews. When is Electric Insurance Agency open? Electric Insurance Agency is closed now. It will open. Employee reviews for companies matching "electric insurance company". results for employers related to "electric insurance company". Electric Insurance overall culture is rated C+ based on ratings from 5 Electric Insurance employees. Last updated a month ago. Learn about Electric. Electric Insurance is ranked #15 on the Best Insurance Companies to Work For in Massachusetts list. Zippia's Best Places to Work lists provide unbiased, data-. Electric Insurance Company's rating is based entirely on customer reviews written on Clearsurance. The rating is determined using an algorithm. Electric Insurance isn't what it use to be. Too many jobs are getting eliminated. Budget has been drastically reduced. Employees are expected to take on more. Learn what working and interviewing at Electric Insurance Company is really like. Read real reviews, ask and answer questions. 0 Reviews of Electric Insurance, 0 TrustScore; The most trusted quality for financial companies. TrustFinance hosts reviews to help financial companies with. Get 5 star insurance for your electric vehicle. ThinkInsure Google 5 star reviews. Rated out of 5 stars in Google reviews. See what our customers are. Here's where you'll find immediate answers to some of the most common general insurance and billing, claims and coverage-related questions. The MINI Electric is a fun, fast and chic small electric car, but its relatively modest driving range may put some buyers off. Electric vehicle car insurance can cost more, but it's still possible to save on premiums while helping the environment. Personal Injury Protection (PIP) is the portion of the auto policy that provides coverage for medical expenses as the result Reviews, and provide Case. logo image of Demotech, Inc. Serious About Solvency®. Learn more about T-Rex vs. Dragonfly · Financial Stability Ratings.

Petplan Reviews Bbb

Petplan pet insurance covers up to 90% of vet bills for dogs & cats. Get a free quote today! Our mission is to ensure healthier, longer lives for pets and peace. rating from the Better Business Bureau (BBB). The ASPCA receives a royalty Petplan · Insurance Ranked logo. Company. About/Contact. Legal. Privacy Policy. BBB Directory of Pet Insurance in USA. BBB Start with Trust ®. Your guide to trusted BBB Ratings, customer reviews and BBB Accredited businesses. Also, check with your state's Department of Insurance to see if any complaints have been filed for this company. Better Business Bureau, tomcraft.ru Additional. This organization is not BBB accredited. Insurance in Bolingbrook, IL. See BBB rating, reviews, complaints, & more. Make sure you research what customers are saying about the company. · Check with your state's Department of Insurance to see if any complaints have been filed. Do you agree with Petplan's 4-star rating? Check out what people Petplan Reviews. 17, • Excellent. VERIFIED COMPANY. In the Pet Insurance. Our friends at Petplan Pet Insurance helped us identify these top four WE ARE BBB ACCREDITED. David M. Kulawiak, Inc. BBB Business Review. ACA. View customer complaints of Pets Best Insurance Services, LLC, BBB helps resolve disputes with the services or products a business provides. Petplan pet insurance covers up to 90% of vet bills for dogs & cats. Get a free quote today! Our mission is to ensure healthier, longer lives for pets and peace. rating from the Better Business Bureau (BBB). The ASPCA receives a royalty Petplan · Insurance Ranked logo. Company. About/Contact. Legal. Privacy Policy. BBB Directory of Pet Insurance in USA. BBB Start with Trust ®. Your guide to trusted BBB Ratings, customer reviews and BBB Accredited businesses. Also, check with your state's Department of Insurance to see if any complaints have been filed for this company. Better Business Bureau, tomcraft.ru Additional. This organization is not BBB accredited. Insurance in Bolingbrook, IL. See BBB rating, reviews, complaints, & more. Make sure you research what customers are saying about the company. · Check with your state's Department of Insurance to see if any complaints have been filed. Do you agree with Petplan's 4-star rating? Check out what people Petplan Reviews. 17, • Excellent. VERIFIED COMPANY. In the Pet Insurance. Our friends at Petplan Pet Insurance helped us identify these top four WE ARE BBB ACCREDITED. David M. Kulawiak, Inc. BBB Business Review. ACA. View customer complaints of Pets Best Insurance Services, LLC, BBB helps resolve disputes with the services or products a business provides.

Healthy Paws Pet Insurance. 5 Star Rating Read Full Review 1, Reviews. Consistently #1 in customer satisfaction, A+ BBB Petplan Pet Insurance. Star. Embrace's A+ rating with the BBB and excellent online reviews make it a popular choice among pet owners. Policyholders praise its broad coverage and fast. petplan pet insurance logo. Name of Insurance Provider Petplan Pet Insurance; Year of Establishment ; Key Features A+ rating from BBB, Hassle-free claims. That's a scam. These people should be ashamed of themselves and this vet should be arrested. Business response. 04/02/ We are very. Petplan Pet Insurance. ( reviews). Pet Insurance · Add Review · Call. Directions. Website better business bureau. What scam artists these guys are! My. I have had a good experience with Pet Plan. I signed up right when I got my pup at 4 months or so. She is 6 years old now and the monthly cost. Customer Service · Excludes bilateral limb conditions · No BBB rating is available, since Odie is a newer company · A $2 transaction fee is required · No coverage. “You really can't get better customer service than Pet Plan. Their reps are fantastic at explaining benefits and they take all the time you need to ask. Nationwide Dropped Coverage for my Senior Dog. “I have been a Nationwide pet insurance customer for 6 years and overall had a good experience with claims and. Note that complaint text that is displayed might not represent all complaints filed with BBB. EasyCare Pet: Plan Codes: TCP, TPP Provides all coverage. View customer complaints of Pumpkin Insurance Services, BBB helps resolve disputes with the services or products a business provides. Our rating is based on Pets Best's Plus plan. For broader coverage (at a higher price), consider the Pets Best Elite plan. More: Pets Best Pet Insurance Review. Pet Assure has an A+ rating with the Better Business Bureau (BBB) and has been an accredited business since Customer reviews on the BBB website give Pet. BBB complaints, Facebook page comments, website reviews apparently they ALL suck. Like, looking from at the aggregate of reviews from Joybird, Apt2b. The insurer has some of the strongest customer satisfaction ratings of the companies we reviewed according to its profile with the Better Business Bureau (BBB). This organization is not BBB accredited. Pet Insurance in New York, NY. See BBB rating, reviews, complaints, & more. reviews. That said, the company only has a star rating through the Better Business Bureau (BBB) based on customer reviews. Cons. Number of. Nationwide stands out from other insurers in our review for the variety of pets it can insure. In addition to dogs and cats, it also has coverage available for. rating from the Better Business Bureau (BBB). The ASPCA receives a royalty Petplan · Insurance Ranked logo. Company. About/Contact. Legal. Privacy Policy. rating from the Better Business Bureau (BBB). The ASPCA receives a royalty Petplan · Insurance Ranked logo. Company. About/Contact. Legal. Privacy Policy.

Full Coverage Insurance Cost Per Month

The national average cost of car insurance in is roughly $ per year (or $64 per month). This average rate is for a minimum coverage policy. covered by your policy) in the event of an accident. Typically, a higher deductible means a lower rate (or cost per month) for your insurance policy, so if. Average annual premium. The national average cost for full coverage car insurance is $2, per year, or $ per month. Drivers with minimum coverage pay an. It can cost as little as $ monthly or $ annually for businesses such as yoga instructors and accountants, but the exact commercial auto insurance cost. The monthly average cost of car insurance for drivers in the U.S. is $ for full coverage and $53 for minimum coverage. Find quotes for your area. How much is the average cost of car insurance in the U.S? The average cost for car insurance in the United States is $1, per year, or $ per month. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month. insurance company helps cover costs, up to the coverage limit. How can I comprehensive coverage, collision coverage, roadside assistance or rental. But drivers who opt for full coverage pay an average of $ per month. By comparison, the national averages for liability-only and full-coverage car insurance. The national average cost of car insurance in is roughly $ per year (or $64 per month). This average rate is for a minimum coverage policy. covered by your policy) in the event of an accident. Typically, a higher deductible means a lower rate (or cost per month) for your insurance policy, so if. Average annual premium. The national average cost for full coverage car insurance is $2, per year, or $ per month. Drivers with minimum coverage pay an. It can cost as little as $ monthly or $ annually for businesses such as yoga instructors and accountants, but the exact commercial auto insurance cost. The monthly average cost of car insurance for drivers in the U.S. is $ for full coverage and $53 for minimum coverage. Find quotes for your area. How much is the average cost of car insurance in the U.S? The average cost for car insurance in the United States is $1, per year, or $ per month. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month. insurance company helps cover costs, up to the coverage limit. How can I comprehensive coverage, collision coverage, roadside assistance or rental. But drivers who opt for full coverage pay an average of $ per month. By comparison, the national averages for liability-only and full-coverage car insurance.

How much is car insurance monthly? Car insurance costs $60 per month, on average, for a minimum coverage policy, although individual rates might vary. Full. Small businesses pay an average cost of $42 per month, or about $ annually, for general liability insurance. Average Single Coverage Premium/Month. Employer plan, $ ; Member Age, Monthly Cost. Age 18, $ ; Company, Monthly Cost ; Family Type, Monthly Cost. Couple. How Different Car Insurance Packages Protect You and Your Family · Liability Protection · Comprehensive Coverage · Uninsured/Underinsured · Collision Protection. Our car insurance calculator factors in life changes such as marital status and homeownership to provide customized cost estimates and coverage suggestions. $/Month for full coverage here. All insurance rates are disgusting right now, my car and home insurance both gone up significantly. Edit. If you are a low- or moderate-income Californian, you may get help buying insurance from Covered California through monthly subsidies that lower your. Enhanced coverage: Enhanced coverage includes comprehensive, collision insurance full rather than in monthly or quarterly installments. The reduction. If you are a low- or moderate-income Californian, you may get help buying insurance from Covered California through monthly subsidies that lower your. In Texas, the average full coverage insurance will cost you about $ per month. Full coverage auto insurance consists of liability, plus collision car. insurance calculator recommends a minimum set of coverages for your situation. For a full car insurance cost estimate, get a car insurance quote today. How. Car insurance costs $60 per month, on average, for a minimum coverage policy, although individual rates might vary. Full coverage car insurance is more. Use Allstate's car insurance calculator to estimate how much auto insurance coverage you may need and what it could cost. Monthly premium x 12 months: The amount you pay to your plan each month to have health insurance. Deductibles: How much you'll spend for certain covered. How much is car insurance per month? Many factors including your location What is full coverage car insurance? Car insurance for college students. Drivers in New York pay $ per month on average for minimum-coverage car insurance. monthly premium of $ for full-coverage insurance. New York requires. Full Coverage: In Florida, full coverage car insurance costs an average of $3, per year or $ per month. This coverage includes liability, collision, and. Most of our dog parents pay between $18 and $72 per month. Plus, Embrace goes the extra mile by covering exam fees, saving you an additional $$ per visit. In , the national median monthly cost of a business insurance policy for new Progressive customers ranged from $42 for professional liability to $67 for. Full Coverage: In Florida, full coverage car insurance costs an average of $3, per year or $ per month. This coverage includes liability, collision, and.

Banks Near Me With High Interest Savings

High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. Savings Accounts SaveDailyPack Account iSave High Interest Account VIEW ALL For after-hours digital banking technical support, call You have larger balances and want to earn up to our highest rates. Interest rates. Your rate grows with your balance. Find a branch to learn about rate. Our bank accounts offer high interest rates and easy access to your money. Advantage Account. A high-interest savings me a monthly fee. Does Manulife Bank. With a Saver Savings Account, you are control of how high your interest is. Learn about the rate you would qualify for at Wilson Bank & Trust in Middle TN. With our great rates, growing your savings has never been easier. Earn % Annual Percentage Yieldsuper script 1 with our 7 Month Featured CDsuper script 2. PNC Bank is a large brick-and-mortar bank with approximately 2, branch locations and nearly 18, PNC and PNC Partner ATMs. It stands out on our list for. Discover the power of saving with our high-interest savings accounts. Maximize your earnings with competitive interest rates and no monthly fees. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. Savings Accounts SaveDailyPack Account iSave High Interest Account VIEW ALL For after-hours digital banking technical support, call You have larger balances and want to earn up to our highest rates. Interest rates. Your rate grows with your balance. Find a branch to learn about rate. Our bank accounts offer high interest rates and easy access to your money. Advantage Account. A high-interest savings me a monthly fee. Does Manulife Bank. With a Saver Savings Account, you are control of how high your interest is. Learn about the rate you would qualify for at Wilson Bank & Trust in Middle TN. With our great rates, growing your savings has never been easier. Earn % Annual Percentage Yieldsuper script 1 with our 7 Month Featured CDsuper script 2. PNC Bank is a large brick-and-mortar bank with approximately 2, branch locations and nearly 18, PNC and PNC Partner ATMs. It stands out on our list for. Discover the power of saving with our high-interest savings accounts. Maximize your earnings with competitive interest rates and no monthly fees. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY.

The entire banking staff are friendly, helpful, and knowledgeable. They remember who you are so that they extend a warm greeting when entering locations. If I. Regions LifeGreen® Savings. If you have a Regions checking account, you can save money and earn interest with no monthly fee, no. Island Savings is a credit union that offers a one-stop shop for all your financial needs. Start with a free chequing account and watch your savings grow. Meridian mobile app open on a phone and an award medal that says Ranked #1. Mobile app. Five gold stars. Secure, full-service digital banking. Bank where and. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access. GSB Connect is backed by years of no-nonsense banking, designed with the customer in mind and the best interest rates that make CFOs do a double-take. We. With us, you're not just a customer, you're a member. + Members · Low Mortgage Rates · Online Banking · Friendly Service · Tools and Calculators. Use our branch locator to find your closest Provident Bank location. Branch Locator. Quick Links. Calculators · Education · Careers · Contact Us · badge image. Easily links to other accounts, with EQ or another bank. Not the highest amount of interest offered by EQ bank; No brick-and-mortar locations of EQ Bank. This chart summarizes Canadian high interest savings account rates and is for informational purposes only. The rates are subject to change. Grow your savings with our high-interest savings account. Earn % APY 1 guaranteed for the first 5 months. myRewards Savings is a savings account with interest to help you save for your goals. Open a savings account online or in a branch. The interest rates and Annual Percentage Yields displayed here are for the Wells Fargo Bank locations in the California counties of Alameda, Contra Costa, Marin. Take advantage of Western Alliance Bank's high-yield savings account interest rates and start growing your savings faster. FDIC-insured and no banking fees. Communicate with us securely through our Online Banking secure messaging system. high interest rate savings account. Related Deals and Offers. Citadel has. The digital banking tools available from UFB Direct, including the Mobile Banking app, are designed to simplify budgeting and account management. With EQ Bank Canada digital banking, you get everyday banking that earns high interest—plus payment options and investment products. banking app. We do this by offering Members profit sharing, low borrowing rates, high interest savings accounts and great financial advice — that's the DUCA. This account is perfect for short-term savings goals, as a starter account for kids or just as a great, all-around, simple saving account. They offer a higher interest rate than a traditional savings account in exchange for leaving your money untouched for an agreed upon time. Minimum opening.

Should You Buy Gold Bars

Gold bars are an incredibly safe investment. They are not subject to inflation, devaluation, or any other economic or political risk. 4. Gold. Many would suggest that the key to buying for speculative purposes is buying not just when prices are low, but when they are likely to rise. Gold bars tend to be cheaper to manufacture compared to gold bullion coins. Therefore, they have a smaller premium compared to gold bullion coins. When you buy gold for investment purposes that is also segregated you should always be given the list of serial numbers of the bars that you bought. For bars. Investing in gold may provide investors with a hedge against inflation and economic uncertainty. It can also diversify an investment portfolio, reducing overall. It belongs % to you. There is no need to go through a counterparty or worry about regulatory formalities when buying or selling gold coins or bars. How. Numismatics are probably not a good idea if you don't have expertise. Bars are low premium but it's also easier to fabricate fake bars than. Physical gold, unlike its paper counterpart, is a safe haven and can dependably diversify your portfolio, protecting it against volatility in other assets. It. Investing in gold can often be a prudent choice for those seeking to diversify their portfolios, hedge against inflation, and protect their assets during. Gold bars are an incredibly safe investment. They are not subject to inflation, devaluation, or any other economic or political risk. 4. Gold. Many would suggest that the key to buying for speculative purposes is buying not just when prices are low, but when they are likely to rise. Gold bars tend to be cheaper to manufacture compared to gold bullion coins. Therefore, they have a smaller premium compared to gold bullion coins. When you buy gold for investment purposes that is also segregated you should always be given the list of serial numbers of the bars that you bought. For bars. Investing in gold may provide investors with a hedge against inflation and economic uncertainty. It can also diversify an investment portfolio, reducing overall. It belongs % to you. There is no need to go through a counterparty or worry about regulatory formalities when buying or selling gold coins or bars. How. Numismatics are probably not a good idea if you don't have expertise. Bars are low premium but it's also easier to fabricate fake bars than. Physical gold, unlike its paper counterpart, is a safe haven and can dependably diversify your portfolio, protecting it against volatility in other assets. It. Investing in gold can often be a prudent choice for those seeking to diversify their portfolios, hedge against inflation, and protect their assets during.

Protect your financial future by buying gold bars in a gold IRA or to store at home. Unlike fiat currencies, gold's value has stood the test of time. Even if. For collectors, gold numismatic and rare coins are the way to go. However, we do not advise our high-net-worth clients looking to make gold investments to buy. Buying gold bars is a highly effective method of safeguarding your wealth. It's an investment that provides a sense of unparalleled security in an uncertain. Gold bars tend to be cheaper to manufacture compared to gold bullion coins. Therefore, they have a smaller premium compared to gold bullion coins. By buying gold bars, it can safeguard your finances in the future, in case they need access to finance. Gold bars have lower premiums. Higher production costs. By buying gold bars, it can safeguard your finances in the future, in case they need access to finance. Gold bars have lower premiums. Higher production costs. Buying gold bars in the United States can be a lucrative and secure investment if done correctly. By understanding the types of bars, evaluating. Focus on buying gold bars with a fineness of and above. This designates 24 karat gold, which is % pure gold. Realistically % is the most common. Long-term Wealth Preservation: Physical gold, whether in coins, bars, or bullion, is the go-to for those focusing on long-term wealth preservation. It's a. Banks and other big investors do buy gold, other precious metals, and commodities like oil, to hedge against inflation and other economic risks. Some investment. We believe that you should invest in both gold coins and gold bars. This is the best way to hedge your bets, spread your risks, and diversify your portfolio. There are licensed gold dealers all over the place. They're regulated so you find one and they'll just buy it for whatever the spot price is. Central banks buy it for stability. It's a financial instrument. It's also useful for electronics and jewelry. Bars are just a way to save. Investing in gold bars is almost always cheaper than buying the same weight in gold coins - and the bigger each bar, the lower the cost by weight. Because gold. Hedge - Gold and silver bullion are invested in by individuals and large banks alike, as a hedge against a number of factors - uncertainty, inflation, deflation. Gold bars attract a smaller premium as opposed to bullion coins due to their larger unit size resulting in lower manufacturing costs. Gold bars are a timeless and reliable investment that can enhance your portfolio's security and performance. By investing in gold bars from the U.S. Gold Bureau. The most effective way to keep premiums at an absolute minimum is to buy gold bars, or silver bars if you are looking to invest in silver bullion. Investing in silver bullion coins Coins certainly offer more interest than bars. There are many different gold and silver designs available, but if you want. Gold bars are a better way of investing in gold. These large bars are usually available at the lowest prices as compared to their smaller counterparts.